- Contact Us Now: 754-400-5150 Tap Here to Call Us

False Documents and Perjury in Foreclosure Court – Our Latest Appeal

Strong words, so we’re gonna let the facts speak for themselves:

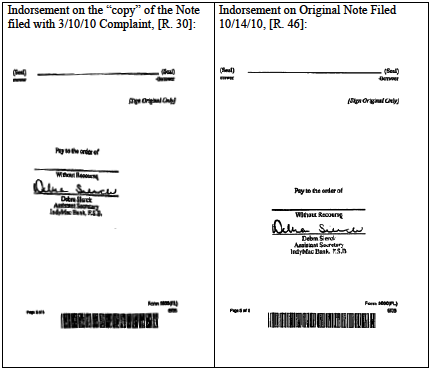

There is supposed to be only one Note… At trial, the bank’s lawyer argued that standing at inception was established solely by comparing the indorsement on the “copy” of the Note filed with the initial Complaint with the indorsement on the Original Note, which was later filed with the Court. Specifically, he said:

. . . to establish standing in this case is a simple matter. The Plaintiff in this case — the original Plaintiff was OneWest Bank. And OneWest Bank, upon filing the complaint, had a copy of the note attached to the complaint. This was promptly followed, Your Honor, with filing that same — the original note for that complaint. The endorsements that were in the copy that was filed with the [Complaint] are the same endorsements that were in the original that was filed with [t]he Court. (emphasis added).

[Trial P. 107, Ln 15-25].

However, with respect to showing whether OneWest had standing, the filing of a copy of the complaint is the standing that’s shown here. There was a copy filed with the complaint. And [then] when the original [note] was then filed promptly after that, there isn’t any change to the endorsements. (emphasis added).

[Trial P. 108 Ln 8-13].

Seems like there might be a problem with his theory…. Nothing about a “copy” of a Note, with an indorsement in a different place than as shown on the original, establishes proof that the Plaintiff was in possession of the original Note, at the inception of the litigation.

As to the perjury part of this, in February of 2010, a Florida Rule of Civil Procedure was amended requiring Banks to verify their complaints. As a Florida Circuit Court Judge wrote, “[t]his is one of the few times in the history of Florida jurisprudence where the Florida Supreme Court has deemed it necessary to subject an entire industry to special rule due to the industry’s documented illegal behavior. The amendment of Fla. R. Civ. P. 1.110 (b) was a direct result of the robosigning scandal. The comments to the rule amendment, In re Amendments To The Florida Rules Of Civil Procedure, 44 So.3d 555, 556 (Fla. 2010) indicate the depth of the court’s concern with this industry.”

In this case, the Plaintiff failed to “verify” their initial complaint. At the first trial, instead of dismissing the case, the Court granted the Plaintiff another chance. After filing their “Verified” Amended Complaint, we took the deposition of the “verifier” and here’s the highlights of that deposition:

Paragraph 5 of the “Verified” Amended Complaint states: “Plaintiff is the holder of the note and is entitled to enforce the terms of the note and mortgage pursuant to Florida Statute 673.3011(1).”

Q. …What is a holder?

A. The holder of the note is basically who is in possession of the note.

Q. …as far as being in possession, that’s what a holder means?

A. Yes

Q. And what is Florida Statute 673.3011 subsection one? What does that say?

A. I don’t know.

[Depo. P. 45 Ln. 25 – P. 46 Ln. 11].

As per Florida Statute 671.201(21), a “holder” is more than just who is in possession. Regardless, as demonstrated at trial, the Plaintiff wasn’t even in possession.

When asked, from paragraph 10 of the Amended Complaint, what it means to be vested in title, the verifier answered: “[t]hat they are currently the — who’s in possession of the house.” [Depo. P. 48 Ln. 4-5].

Paragraph 11 of the Amended Complaint states: “All conditions precedent to the acceleration of this mortgage note and to foreclosure of the mortgage have been fulfilled and have occurred.”

Q. What is a condition precedent? What does that mean?

A. I don’t know.

Q. How about acceleration? What does that term mean to you for purpose of the foreclosure lawsuit?

A. I don’t know.

Paragraph 12 of the Complaint which simply alleges that the bank retained counsel and was obligated to pay them.

Q. How did you know that Plaintiff retained an attorney and was obligated to pay an attorney in this case?

A. I don’t know.

[Depo. P. 48 Ln. 7-12].

Paragraph 14 of the Amended Complaint alleges that an unknown spouse may have homestead or other rights to the property which are inferior to the bank’s.

Q. Okay. What are homestead rights?

A. In case there’s a homeowner’s association.

[Depo. P. 49 Ln. 12-13].

Additionally, the verifier did not understand any of the terms found in the wherefore clause of the “Verified” Amended Complaint.

Q. Okay. It says here in the wherefore – in this wherefore area here in the second line, abstracting. What is abstracting?

>A. That’s something – that’s more standard verbiage that’s put in. I don’t know.

Q. What does it mean to foreclose the mortgage?

A. That’s verbiage that the law firm puts in.

Q. And you’re not sure what that means?

A. No.

Q. How about securing the indebtedness? What does that mean?

A. I’m not really sure.

Q. Okay. What does it mean to satisfy the Plaintiff’s mortgage lien?

A. I’m not really sure of the terminology.

Q. How about Florida Statutes 45.031, do you know what that says?

A. No.

Q. What does it mean that Defendant’s claim be forever barred?

A. I don’t know.

Q. How about what does it mean to appoint a receiver?

A. I’m not sure.

Q. Okay. How about sequestration of rents, issues, income, and profits? Do you know what that means?

A. No.

Q. How about Florida Statute 697.07? Do you know what that says?

A. No.

Q. What’s a writ of possession?

A. I don’t know.

Q. How about a deficiency judgment? What does that mean?

A. I’m not sure.

[Depo. P. 50 Ln. 3 – Pg. 51 Ln. 13].

For more on why not “knowing” any of the key facts in a complaint “verified” to the best of one’s “knowledge and belief” is perjury, read the Initial Brief here:Initial Brief